Performance of FWM ESG Portfolios

A difficult year for everyone!

In 2021, over $500 billion flowed into ESG (Environmental, Social, and Governance) funds, and at the beginning of 2022 it was expected that similar growth would continue. However, 2022 has proved to be a difficult year for investment markets in general, let alone when you involve the difficult addition of ESG.

Investment Metrics, a global provider of portfolio analytics, found that 78% of global ESG equity products have underperformed their benchmark throughout 2022. Of course, this had not always been the case, prior to 2022, 80% of the same cohort of ESG funds beat the MSCI World Index, a broad global equity index that represents large and mid-capitalisation equity performance across all 23 developed countries, over a three-year rolling period to June 2022. This large drop-off in performance through 2022 has largely been attributed to ESG funds being ‘growth orientated’.

By way of an explanation, ‘growth’ funds are funds that invest in companies based on their possible future growth and earnings prospects, rather than a company’s current earnings (which might still be modest or non-existent in nature). Whereas a value stock or fund are those with cheaper valuations. The cheaper valuations can be for several reasons: an industry in decline, earnings falling or deemed to be of lower quality or more volatile nature, or at times to reflect widespread cheapness due to systemic reasons such as Brexit or following market corrections. But in comparison to growth stocks, value stocks are priced to expect relatively less future earnings growth.

The concept of ESG is still very much future facing, although it is quite quickly appearing in our lives more and more; just look at how many electric vehicles we now drive past, or even drive ourselves, but because of this ‘futuristic’ aspect of ESG and the expectations for high earnings growth in ESG companies, in means that in nearly all cases, ESG companies are examples of ‘high growth’ companies, rather than those low growth ‘value’ investments which have performed so well this year. If we compare the MSCI World Growth Index to the MSCI World Value Index, it has underperformed its counterpart by 18.1% year-to-date (YTD).

At the beginning of 2022 we witnessed a large rotation out of the high growth names into the lower growth value orientated names, predominantly due to the high inflation and rising interest rate environment, which can, in part, largely explain some of ESGs relative underperformance to the wider market. When we experience the high levels of inflation we are currently witnessing, it forces central banks to increase interest rates to attempt to tame inflation and bring it back down to the target of 2%. With inflation expected to be higher over the medium-term and interest rates also increasing, it presents a large mechanical discounting effect for share prices, where investors can no longer justify the high valuations from equities that have been accepted in the low inflation, low interest rate environment over the past decade, when they are now able to get a 4% return from a “risk-free” Government bond. This then leads a scenario that we have experienced year-to-date where there is a large re-pricing of stock share prices, especially those with greater promises of more distant, future cash flows such as growth stocks trading at more elevated valuation levels.

In addition to this, with higher interest rates, companies borrowing costs increase greatly. Some ‘high growth’ companies, including those in ESG funds, tend to have large amounts of debt on their balance sheets to fuel future growth. As interest rates rise, their debt servicing costs also increase, impacting their future earnings, and once future earnings forecasts are downgraded, investors will again no longer be willing to pay a high premium for that company. Furthermore, financing opportunities may even cease for more speculative projects or earlier stage growth companies when the price of money suddenly rises. The knock-on effect can be seen in many companies in 2022, who have seen their share price and market capitalisation tumble.

As future facing companies, it is then of course no surprise that a lot of the ESG market is dominated by technology driven companies. The technology sector has been the ‘darling’ of the 2010s, providing investors with may high growth companies that have performed exceptionally well. For the reasons above, 2022 has been an extremely difficult YTD for the sector, and this has been evident in the performance of the NASDAQ 100 Index, a basket of 100 actively traded US stocks that is heavily concentrated with technology companies, which has so far at time of writing returned -29.65% YTD.

The risks of ESG

As ESG funds are still a relatively new concept, in the greater scheme of things, it means they suffer from two risks that a standard non-ESG fund may not: higher volatility and ‘single stock risk’. To highlight this, over the past 20 years, the ESG funds that were in existence have averaged volatility of 15.46% compared to the S&P500, a major US benchmark of the 500 largest companies, with no ESG consideration, which has experienced volatility of15.04%. Though this added risk is only modest, many ESG funds tend to have a much larger portion of the portfolio in smaller and mid-capitalisation stocks, which exhibit higher risk tendencies. ‘Single stock risk’ is due to 1 in 10 ESG funds having their largest holding at 10% or more of the fund, which as you can probably gather, provides considerable risk with so much of a portfolio focused on one holding. With these three points in mind, higher volatility is a common factor among ESG portfolio.

Fiducia Performance and Comparison

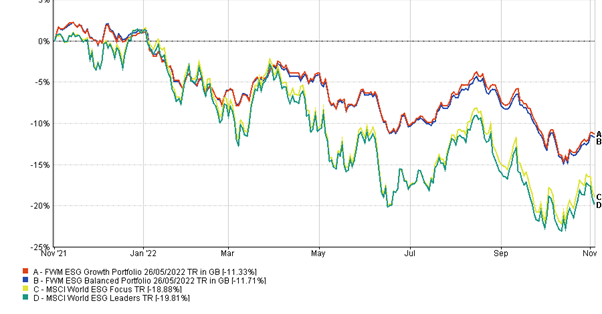

With all of this in mind, if we now look at the Fiducia Wealth Management ESG Balanced and ESG Growth portfolios and compare their performance to the performance of the MSCI World ESG Leaders & Focus Indexes, both of which provide exposure to companies with high ESG performance relative to their sectors and peers, over a 1-year period, we can see below that against their peers the Fiducia portfolios have held up well, albeit still providing negative returns. It is important to note here though that the ESG indexes used for comparison are 100% equities, which the Fiducia Wealth Management aren’t and will explain why the Fiducia portfolios have only suffered roughly 60% of the loss.

Now, we understand that in absolute terms this performance is disappointing, and it is always difficult to see the portfolio drop by this amount. However, it does sometimes help to look at the investments on a relative basis and compare to a suitable benchmark.

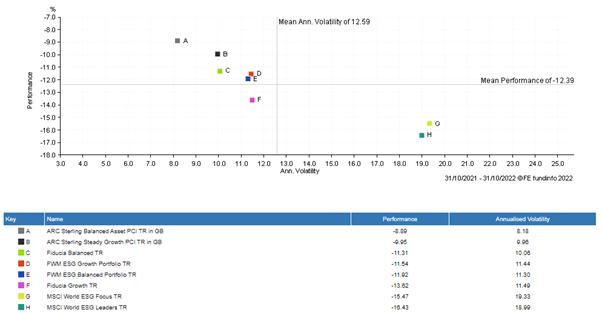

By way of another comparison, you will also see below that despite the earlier factors mentioned, the Fiducia ESG portfolios have returned similar performance to the standard Fiducia models, and their non-ESG benchmarks, whilst significantly outperforming their comparative ESG benchmarks, over a 1-year period.

Earlier I mentioned how ESG portfolios can suffer from higher volatility when compared to a portfolio with no ESG consideration. Below it can be seen that both the Fiducia ESG balanced, and growth portfolios have achieved their returns with a level of volatility nearer to a ‘standard’ portfolio rather than the volatility experienced by the main ESG benchmarks (as depicted by FWM Balanced or FWM Growth, non-ESG versions).

Deeper Dive

Following attribution analysis run on the Fiducia ESG portfolios, the asset classes that have contributed the most to the negative performance YTD has been bonds, property, and UK equities. Most disappointing about this is that if we run the same analysis for these three asset classes to a period pre-mini budget, the returns are 50% greater than they are now post-mini budget. It has been well documented in the media how the mini budget has affected the economy, but with regards to these three asset classes, it caused sharp increases in borrowing costs, causing bonds and property values to tumble, and the £ also to free-fall, though it has now bounced back to some extent: all of which placed a large strain on UK equity markets, that did have a large impact on the portfolios. You will note a fairly large drop-off in the above charts around the mid-September time.

What are we doing going forward?

Now, in absolute terms, the above is not necessarily providing too much comfort, however, it has shown that on a relative basis, it is not all doom and gloom! Following recent sell offs, large discounts in the markets have appeared and we believe there are now several buying opportunities for these depressed assets. For example, we have slowly been recycling some of the returns from the better performing absolute return funds into the ethical bond and property funds, which have both experienced a significant sell off YTD.

Two appealing investments we want to highlight that we have made this year have been the Baker Steel Electrum and Amati Strategic Metals, both of which are future facing ESG, electric vehicle metals and commodities funds. With the worldwide push for the transition into renewable ESG energy to happen over the coming years, the metals these funds invest into, such as copper and lithium, are critically important, and with this in mind, we see this as a high conviction play with strong long-term expectations.

Long-term mindset

As a final note, as long-term investors, it is always important to take a step back and look at where we may be in 5+ years. ESG is still new, but we can be certain that it is most definitely going to be sticking around and be a large feature of our lives going forward. Making a position early, and now, as we have, is only ever likely to provide positive long-term returns. A long-term mindset is key.

Important information

This document is prepared for general circulation and is intended to provide information only. The information contained within this document has been obtained from industry sources that we believe to be reliable ad accurate at the time of writing. It is not intended to be construed as a solicitation for the sale of any particular investment nor as investment advice and does not have regard to the specific investment objectives, financial situation, capacity for loss, and particular needs of any person to who it is presented. The investments contained in this document may not be suitable for all investors. Prospective investors should carefully consider whether any of the investments contained in this document are suitable for them in light of their circumstances and financial resources.

If you are in any doubt whether any of the investments contained in this document are suitable, you should take appropriate advice from a professional adviser, such as an accountant, a lawyer or Financial Adviser authorised and regulated by the Financial Conduct Authority.

Investment Risks

- The value of investments and the income from them can fall as well as rise. An investor may not get back the full amount of money that they invest. Past performance is no guide to future performance.

- Foreign currency denominated investments are subject to fluctuations in exchange rates that could have a positive or adverse effect on the value of, and income from, the investment.

- Investors should consult their professional advisers on the possible tax implications and other consequences of their holding of any of the investments contained in this publication.