Using Pensions & ISAs to provide liquidity in times of property market stress

The property market can be unpredictable at the best of times, and during times of stress, it can be difficult to liquidate property assets quickly. However, pensions and ISAs (Individual Savings Account) can provide liquidity and different tax benefits during these times, alongside any property investments, making them a valuable tool for investors to consider.

During the property market selloff of 2007/08 , many investors found themselves with assets that were difficult to liquidate quickly. However, those who had invested in pensions and ISAs were able to access their funds quickly and without significant tax implications. Pensions and ISAs provide tax benefits such as tax-free growth and tax-free withdrawals, making them an attractive option for investors who are looking to protect their assets during difficult market conditions.

Pensions offer several advantages. Firstly, contributions to pensions can benefit from receive tax relief, which can help to reduce an investor’s tax liability. Secondly, investments held within a pension are not subject to capital gains tax, which means that investors can benefit from tax-free growth on their investments. Finally, pensions provide a tax-efficient way to withdraw funds during retirement, with 25% of the fund available to withdraw tax free.

ISAs are a valuable tool for investors during times of market stress. Like pensions, ISAs provide tax benefits such as tax-free growth and tax-free withdrawals. Additionally, ISAs provide flexibility for investors, as they can be accessed at any time without penalty. This means that investors can liquidate their assets quickly if needed, without incurring significant tax implications. The annual limit for investing in a cash or stocks and shares ISA is currently £20,000.

Both pensions and ISAs offer tax-efficient methods for building savings and investments that can be used to fund retirement over the long term – much like a property portfolio. The main advantage of an ISA is that it offers more flexibility than a pension. You can withdraw money from an ISA at any time without penalty, whereas pensions have restrictions on when and how much you can withdraw. However, the lack of tax relief on contributions means that ISAs may not be as tax efficient as pensions for those in higher income tax brackets.

What does your retirement planning look like?

I am not suggesting that you should not invest in property to provide a source of income during your retirement. However, in terms of having assets that provide liquidity in times of market challenges, pensions & ISAs can provide you with peace of mind. They provide access to funds when needed, quicker than a property sale.

Both pensions and ISAs provide a level of liquidity and access to funds, unlike property. They allow you to withdraw cash when needed. For instance, you can withdraw up to 25% of your pension savings tax-free and can also choose to take flexible withdrawals from your pension fund. This can provide a useful source of income and allow you the freedom in retirement to manage your finances in the way that suits you best.

When it comes to retirement planning, both pensions and ISAs have a significant role to play. Pensions can be an effective way to save for retirement due to their tax relief and long-term investment opportunities, while ISAs offer flexibility and tax efficiency for those who want more control over their savings.

Ideally, a combination of these two investment tools can provide you comprehensive and effective retirement plan alongside any other investment strategies you have – including a property portfolio.

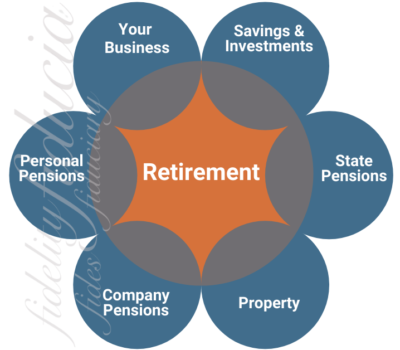

The graphic across the page highlights where retirement income can come from. As illustrated, it can be a combination of products/assets and often I have found those with a more diversified asset base have a more robust financial plan in retirement.

In conclusion, pensions and ISAs are valuable tools for any investor during times of stress in the property market. They provide diversification, liquidity and tax benefits that can help to protect an investor’s assets during market selloffs. By investing in pensions and ISAs, investors can benefit from tax relief on contributions, tax-free growth, tax-free withdrawals, and a tax-efficient way to withdraw funds during retirement.

At Fiducia, we strongly recommend a diversified investment approach to help remove any specific liquidity risk which may occur during times of challenge. Additionally, we look to protect a client’s wealth over the long term to ensure they can meet their long-term financial goals.

For more information or to speak to a regulated Financial Adviser about your investment strategy/plan, contact our team via the button below.