Fund Manager Q&A: Kames Property Income Fund

What is the strategy behind the fund?

The fund invests in direct and indirect real estate assets without the use of debt. Stock picking of good quality assets offering attractive income returns, good value or asset management potential and, subsequently, delivery of planned active management, will be the main source of added investment return.

Direct property

The Fund was launched in March 2014. Once up to scale, up to 80% of the fund will be invested in direct property assets. Around 50% of the direct property component will invest in ‘value-add’ assets. Value-add/asset management initiatives include re-negotiating, or extending, leases; letting vacant space; construction of additional space; refurbishments of existing space; and widening/improving planning consents and changing the use of properties, eg from office to residential. Approximately 30% of the direct property portfolio of the fund will be invested in core/longer income commercial assets of £5 – £20 million. ‘Core’ properties will typically have longer leases and/or be let to higher quality tenants and/or be located in more prime locations. We would expect these buildings to be in very good condition and require no, or limited, capital expenditure.

These ‘core’ properties are likely to be more liquid than the ‘active value’ element of the portfolio, particularly those ‘active value’ properties which are the subject of ongoing asset management initiatives. Income streams are anticipated to be more stable but returns from this element of the portfolio are not, on a long term basis, expected to be as high as those of the ‘active value’ element. The 60:40 split represents a guide to the likely weighting of the direct portfolio over the long term but these weightings may be varied in order to take advantage of market conditions. For example, where opportunities in the ‘active value’ space are better on a risk-adjusted return basis, the allocation to that element may be increased beyond the 60% level. At other times, the manager may seek to increase the weighting to core properties, particularly where increased liquidity is required within the fund. Under normal circumstances, the manager would expect to operate with a maximum exposure to ‘active value’ properties of c75% and a maximum exposure to ‘core’ properties of c50%.

Indirect property and cash

In order to provide greater liquidity, approximately 20% of the fund may be invested in indirect property. An element of the fund may, therefore, also be invested in the following:

Property companies

REITs (Real Estate Investment Trusts)

Property Investment Trusts

Onshore and offshore property funds

The fund will also hold cash and money market instruments for liquidity and efficient portfolio purposes.

How does this strategy allow the fund to pay a higher income yield than most peers?

Income is a key focus of the Fund’s objective and is an important factor in the investment decision-making process. The Fund reached its first anniversary on 1 April 2015, having delivered an actual distribution yield of 4.91%* and a direct property yield of 7.35%*. We are pleased with this result in a year when cashflows into the Fund were very high. The Fund aims to deliver a competitive income and has a target yield of 5.5% p.a.** when fully invested. The team’s ‘Active Value’ investment strategy seeks to exploit the current wide yield gap between prime and secondary property and focusses on buying opportunities among secondary properties in the £4m to £15m range.. Our strategy leads us to seek properties outside London as well as ‘value’ assets, where we have a track record of uncovering attractive opportunities. We have access to a rich source of investment opportunities: from banks, private-equity companies and other ‘motivated sellers’ with whom we have established relationships. We believe our strategy is ideal for the current environment and we are well positioned to benefit from it.

How do you see the property market performing over the next one to two years?

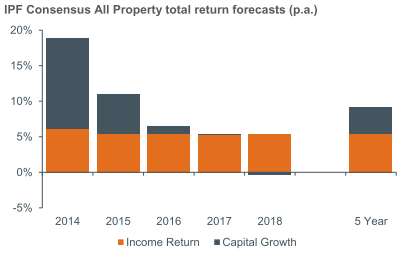

The outlook for the UK commercial property market remains positive. Investor demand remains buoyant with pools of equity from a wide range of buyers remaining to be invested, whilst easing credit conditions also provide support for debt-backed investors. In addition, positive GDP growth is likely to continue supporting occupier markets and further positive rental growth. Despite the potential macro risks, we do not see deflation or interest rate rises to be a systemic risk to the property market unless they are prolonged or excessive. The IPF Consensus Forecasts – an industry average of return forecasts by agents, fund managers and researchers – projects another good year of double-digit total returns in 2015 and as a result we continue to have confidence of a healthy return outlook from the UK property market. Looking further into the future, we believe returns will moderate over the medium term, but remain underpinned by income. The Property Managers Association is projecting a total return of 5.2% over the next five years (to the end of 2019) but we believe there is scope for the actual figure to be higher.

In addition, we believe there will be a wide divergence in returns between different sectors of the market. This gives investors the opportunity to add considerable value by judicious investment decisions. In broad terms, our favoured sectors are alternatives such as primary healthcare, student accommodation and leisure, multilet industrial estates in London and the South East, and South East office. Meanwhile, we believe he underperformers are likely to be Central London offices, residential property and the retail sector.

What do you anticipate the biggest challenges will be for the fund for the rest of 2015?

As the Fund is still growing, there can be a build-up in cash while we go through the due diligence process that is required before we deploy that capital. Some of that cash (a target of around 10%) remains in cash assets. And the remaining 10% of our target asset allocation is in listed and unlisted property vehicles, such as REITs to gain some exposure to the property market and still ensure an appropriate level of liquidity. For example, the Fund has holdings in British Land and Land Securities. While the number of opportunities remains high, we have witnessed increasing competition in the secondary property market as debt has become more widely available and the traditional players in this space (ie small property companies) have started to return to the market. On balance, we are still seeing more than enough opportunities to deliver attractive returns. Given Kames’ track record, and the fact that purchase are made using equity only (the Fund does not use debt), we continue to have a substantial advantage over debt-backed purchasers.

Why do you consider property to be an important part of a diversified portfolio?

As long as UK interest rates remain low, income is therefore going to remain a key theme for investors – particularly those in our ageing population who are looking to start withdrawing money from their pension savings. Property’s yield of around 6% (according to the IPD Index at the end of 2014) is therefore very attractive – especially when around 4.5 to 5 percentage points of that comes from rental income, which is typically very stable through the market cycle. But it’s not all about income. Capital growth will remain a theme in 2015. And even after this year, property investors can still generate decent returns by focusing on good stock selection and securing quality sources of income – for example in the areas of secondary property, healthcare property and selected High Street retail.

This document is not intended for retail distribution and is directed only at investment professionals. It should not be distributed to, or relied upon by, private investors. The Kames Property Income Fund is a sub-fund of Kames Capital Investment Portfolios ICVC (an Open-Ended Investment Company). Kames Capital plc is the Authorised Corporate Director of the Company (ACD). Yield is estimated and based on simulated market proxy portfolios on a fully invested portfolio basis and is net of fees. Charges are taken from capital. The yield is not guaranteed and is subject to change without notice. The value of investments and the income from them may go down as well as up and is not guaranteed.

Where funds are invested in property or indirectly into property, investors may not be able to switch or cash in their investment when they want because investments in direct property and indirect property in the fund may not always be readily realisable. If this is the case and in accordance with the fund’s prospectus we may defer a request to switch or cash in units. Whilst property valuations are conducted by an independent expert, any such valuation is a matter of the valuer’s opinion. The spread between the price to buy and sell is likely to be wider than for other less specialist funds and may vary. There is no guarantee that investments in property will increase in value or that rental growth will take place. There is a risk that a property held in the Fund’s portfolio could default on its rental payments. There is the possibility that a portion of the portfolio will be held in cash if the supply of new investment opportunities is limited which, if the situation persists, may restrict the performance of the Fund.

Funds that invest mainly in one type of asset are more vulnerable to market sentiment. We reserve the right to change the pricing basis of the funds and any change will mean an increase or decrease in the price at which you may deal. References to tax are based on current regulations which may be subject to change. For clarification please seek advice from your financial or tax adviser. Past performance is not a guide to future performance. Your capital is at risk and positive returns or income levels are subject to change and are not guaranteed. Yield based on a fully invested portfolio, which may not be possible, and historic performance, net of fees. Expenses are charged to capital, increasing annual distributions but constraining capital performance. Please see the prospectus of Kames Capital

Investment Portfolio ICVC for all material risks, available from www.kamescapital.com. Kames Capital plc is the Authorised Corporate Director of KCIP. Issued by Kames Capital plc, 3 Lochside Crescent, Edinburgh, EH12 9SA, authorised and regulated by the Financial Conduct Authority, company number SC113505.

This document is accurate at the time of writing but can be subject to change without notification. Kames Capital is an Aegon Asset Management company and includes Kames Capital plc (Company Number SC113505) and Kames Capital Management Limited (Company Number SC212159). Both are registered in Scotland and have their registered office at Kames House, 3 Lochside Crescent, Edinburgh, EH12 9SA. Kames Capital plc is authorised and regulated by the Financial Conduct Authority (FCA reference no: 144267). Kames Capital Investment Portfolios ICVC is an open-ended investment company with variable capital, incorporated in England under the OEIC Regulations. Kames Capital Unit Trust is an authorised unit trust. Kames Capital ICVC is an open-ended investment company with variable capital, incorporated in Scotland under the OEIC Regulations.

If you would like to know more about how we as Financial Advisers can help you with your Investments then visit the Investment Management section of our website: Investment Management or send us email at: [email protected]

The information contained in our website is for guidance only and does not constitute advice which should be sought before taking any action. The information is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change. Accordingly, no responsibility can be assumed by Fiducia Wealth Management Limited, or any associated companies or persons, its officers or its employees, for any loss occurred in connection with the content hereof and any such action. Professional financial advice is recommended for every case.

Fiducia is a multi award-winning firm of Financial Advisers based in Dedham near Colchester situated in the heart of Constable Country on the Essex Suffolk border. www.fiduciawealth.co.uk

Fiducia Wealth Management Ltd. Dedham Hall Business Centre, Brook Street, Dedham, Colchester, Essex, CO7 6AD.

Fiducia Wealth Management Ltd. is authorised and regulated by the Financial Conduct Authority. FCA No. 408210