Fund Manager Q&A: Henderson European Focus

Posted in Investing, Fund Manager Q&A on 22.05.15 ReadPlease summarise your underlying strategy.

The strategy is a blend of top-down sector themes, combined with compelling...

In this article, the first of the series, we begin by introducing the concept of Asset Allocation from an investor’s perspective, explaining the importance of diversification and the dangers of putting all one’s eggs in a small number of baskets.

After explaining this important concept, we will then investigate our first asset class, providing an overview of the Absolute Returns sector.

By the end of our series of articles, we will hope to have given you an insight into the key building blocks that form the Fiducia portfolios.

What is Asset Allocation?

Investors of all levels will no doubt be familiar with the basic premise that it is dangerous to “put all your eggs in one basket”.

Although a fairly obvious piece of advice, this wise principle forms the backbone of professional portfolio management.

The dangers of being overexposed to one basket.

By carefully spreading risk and investing in a large number of unrelated financials assets, the investor benefits by minimising the chance of making a total loss on their capital. If something doesn’t work out as expected, it is likely gains from other investments may offset any losses, thus avoiding danger and allowing positive steps forward to be made overall.

In the investment world, the primary way to reduce risk is by investing in various Asset Classes.

Key asset classes include Stocks and Shares (also known as Equities), Bonds (lending money to Governments or Companies), and Property (this may be Residential or Commercial Property, for example, renting out offices or factories). Other asset classes exist alongside these mainstay traditional choices, including Absolute Return funds, Hedge Funds and Private Equity amongst others.

What are Absolute Return funds?

Absolute Returns funds are a relatively modern asset class as far as retail investors are concerned. This group of investment funds have only started to gain in popularity and feature in investors’ portfolios as an asset class in recent years.

Consequently, many investors – and financial advisers for that matter – are not familiar with the investment strategies employed by Absolute Returns funds and may therefore view them as excessively complicated or mysterious, which we feel need not be the case.

The key lesson

Part of the reason why uncertainty surrounds the asset class is because there is no such thing as an average or typical Absolute Return fund.

However, if there is one key lesson to remember with respect to Absolute Returns funds, it is that they seek to generate positive investment returns under all financial market conditions.

Compared to traditional mainstay asset classes such as Stocks, Bonds and Property, all of which at times endure – sometimes severe – periods of negative returns, the attraction of identifying investments that consistently seek to make positive gains is very clear.

Although in practice it is not always possible to avoid losses (hence the sector is called the Targeted Absolute Returns sector), talented fund managers will generally be able to meet their goal of making steady, relatively consistent investment returns over reasonable time periods – certainly compared to global stock markets, which can be notoriously volatile.

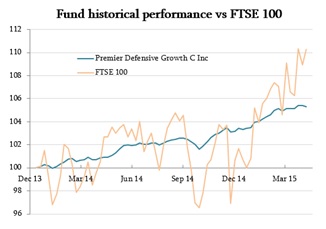

The chart below from FE Analytics shows the performance of the Premier Defensive Growth fund (in blue) compared to the UK stock market, the FTSE 100 (in orange), over the last year, highlighting an example of an Absolute Returns fund meeting its goal of steady, consistent positive returns under testing market conditions late last year.

How do Absolute Returns fund managers attempt to generate consistently positive returns?

First and foremost, all managers in the sector emphasise carefully managing their individual investment positions in order to try to:

As may be apparent from the above, most fund managers in the Targeted Absolute Returns sector tend to apply a defensive mindset and tight risk controls when constructing their investment portfolios.

Examples of Absolute Returns strategies:

To provide an illustration of how Absolute Returns funds try to generate positive returns, some of the Absolute Returns funds used by Fiducia seek to gain from:

Crucially, all the above investment strategies (and others exist beyond the above list) are executed with a significant defensive mindset, focused on preserving capital. Risk management is a critical attribute of successful Absolute Returns funds.

Looking forwards

The funds Fiducia have selected for our Absolute Returns sector have been carefully chosen for their defensive attributes and return generation potential independently of global stock markets; we expect our funds to demonstrate their capital preservation qualities in the event of falling stock and bonds markets.

Our intention is for this asset class to act as a stabiliser for some of the other asset classes that also feature as key long-run components of our investors’ portfolios.

We feel that should financial markets be tested at some point in the medium-term future, by selecting Absolute Returns funds that should be positioned to continue preserving capital and moving forwards, we want our clients to benefit from a much needed cushion when it might be needed most.

We will continue next month with another article in our series, covering the next asset class in your Fiducia investment portfolio.

If you would like to know more about how we as Financial Advisers can help you with your Investments then visit the Investment Management section of our website: Investment Management or send us email at: [email protected]

The information contained in our website is for guidance only and does not constitute advice which should be sought before taking any action. The information is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change. Accordingly, no responsibility can be assumed by Fiducia Wealth Management Limited, or any associated companies or persons, its officers or its employees, for any loss occurred in connection with the content hereof and any such action. Professional financial advice is recommended for every case.

Fiducia is a multi award-winning firm of Financial Advisers based in Dedham near Colchester situated in the heart of Constable Country on the Essex Suffolk border. www.fiduciawealth.co.uk

Fiducia Wealth Management Ltd. Dedham Hall Business Centre, Brook Street, Dedham, Colchester, Essex, CO7 6AD.

Fiducia Wealth Management Ltd. is authorised and regulated by the Financial Conduct Authority. FCA No. 408210

Watch the Fiducia YouTube channel for our Economic and Market updates.

View ChannelOur website uses cookie technology. Learn more about the cookies used on this website, how to manage cookies and how to block cookies (at any time) by clicking here. By using our website you consent to our use of cookies

Privacy Policy