We all know the well worn story of buy a range of assets, occasionally re-adjust and over the years let your portfolio increase in value riding out the storms of near term volatility. The data available now goes back over 100 years especially with regard to US markets and means this makes perfect sense.

The clear conclusion is multi asset portfolio returns over the long term can be circa 4%-7% annualised which gives a decent real return over the current low inflation rate, although if inflation stays low then logically returns will head to the lower end of the range.

Where investors need to be well advised is on short term volatility which can be scary to say the least.

At points of stress, short term market movement can be extreme; the start of World War One (post a market suspension) saw stocks fall over 25% and following the 1929 crash, equities declined in the great depression by more than 40%.

Closer to home, the recovery in 1974 post the oil crisis was dynamic as London stocks rose in 30 days by over 50%. The so called crash of 1987 saw a decline of over 20% in a couple of days ( although oddly enough stocks finished up in that particular calendar year).

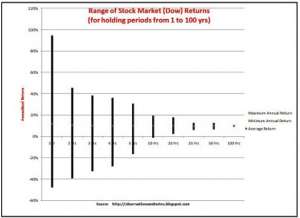

Thus the message is clearly shown by the chart above, the longer you invest for, the more short term volatility is smoothed and the confidence levels of your long term returns should be high.

Of course the future is difficult to predict, so we suggest investors focus their attention on the distribution of potential future outcomes. If you view the future as a distribution of asset returns then the benefits of asset allocation become clear.

Looking at different assets, equities have a higher average expected return than many perceived less risky asset classes, but with a much wider distribution, or put simply they are more “hit or miss” in the short term. So when constructing portfolios we use different assets chosen by our investment managers so as to help our investors mitigate the extreme movements in asset returns. Thus we are able to face the future better prepared, with our analysis and awareness of the extreme market moves of the past.

Experienced advisors that have lived and worked across both market and economic cycles should be able to help through the future volatile times, no matter what the reasons for market movements.

Here at Fiducia we have years of experience so building the right portfolio for all seasons is what we do.