VCT’s and Pensions

Introduced by the government in 1995 to encourage individual investment in UK smaller companies through attractive tax benefits, around £3.65 billion was invested in VCTs between 1995 and 2009 (source: HMRC website). However, they are often considered to be too risky and therefore get overlooked by people who might benefit from using them. There are a number of lower risk VCTs now available and here we will summarise the main features of this type of investment and consider a way of enhancing the tax benefits even further.

VCTs are companies listed on the main market of the London Stock Exchange; since VCTs were launched, they have raised funds at an average of £8.63 million per tranche (source: extrapolated from HMRC website data). The VCT manager will then invest the money over time, in a diversified portfolio of between 20 and 40 companies. VCTs are subject to stringent investment criteria; one being, that the VCT has up to three years to invest at least 70% in UK qualifying companies (unquoted or AIM listed and not one of the excluded sectors). The companies in which they invest must also have a gross asset value of £7 million or less prior to the VCT investing in the company.

The three year investment period means that a high proportion of capital will initially be held in low risk assets such as cash or cash equivalents, while suitable investments are sought.

While it is important not to be driven by tax alone, VCTs are one of the most tax efficient investment products available to UK investors. Assuming investors hold their VCT shares for five years, they are entitled to:

- 30% income tax relief on investments up to £200,000

- Tax-free dividends

- Tax-free capital growth

Inevitably, there are advantages and disadvantages with this type of investment and it is important to understand that VCT investment generally carries inherently higher risks than other typical vehicles such as collectives and large cap shares. The major risks associated with VCT investment are:

- Unquoted companies (UK Smaller Companies).

- Liquidity issues (ability to sell shares).

- Fund management company risk.

- Fund size

- Market timing risk

- ‘Deal Flow’ for chosen manager

It might be argued, however, that the risks associated with VCT investment (if carefully managed) can be outweighed by the generous tax advantages.

It is worth bearing in mind that there is no restriction on the number of VCTs an individual invests in, subject to the overall total investment not exceeding £200,000 in any one tax year. It is therefore possible to reduce the risk by investing in a portfolio of VCTs.

A number of VCT managers also actively seek to invest in companies which are relatively secure, generally because of the type of trade in which they are involved. This might reduce the scope for high returns, but a relatively low but secure return can prove to be attractive when the various tax benefits are taken into consideration.

Combining VCT investment with Pension Planning

In the right circumstances it is possible to combine a VCT investment with Self Invested Personal Pension Plan (SIPP) to further enhance the tax advantages and the net effect of retirement funding, effectively obtaining two levels of tax relief.

For example, an individual could make an initial investment into a VCT, attracting 30% income tax relief and then subsequently transfer the fund into a Self Invested Personal Pension (SIPP) after the qualifying period. This would further attract both basic rate and higher rate tax relief (if applicable) subject to HMRC limits and the SIPP provider’s contractual terms.

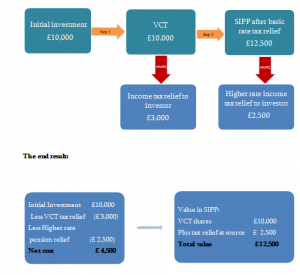

The diagram below explains this scenario and the overall net effect of an initial £10,000 investment for a higher rate tax payer. This is a simplistic analysis and takes no account of investment performance and charges, but is a useful illustration that the net cost of holding £12,500 (no gain/loss) in a SIPP is only £4,500 for a higher rate tax-payer.

In summary, the use of VCT’s in accelerated pension funding will appeal to two types of investors:

- Existing VCT investors (those already through their qualifying period of three or five years who can roll their VCT over into a SIPP now, or shortly).

- Potential VCT investors (those who can benefit from the initial tax advantages and might consider rolling the proceeds into a SIPP in five years time).

VCTs are higher risk investments and are not suitable for all investors. Professional financial advice should be obtained before carrying out any such investment.

The above information is a brief overview and should you wish to discuss VCTs in more detail, please call your usual Fiducia adviser for expert and intelligent advice.

The end result: